Care properties as a stable capital investment

with long-term rental, tax benefits without administrative stress

Stable, predictable, future-proof – your investment in nursing care properties

Long-term operating agreement (20–25 years), indexed rent

No vacancy or tenant management; operator is responsible for maintenance

State tax incentives via AfA (§7b) and KfN subsidies

Low personal investment – possible even with little equity capital

Inflation protection through index-linked leases

Location selection based on demographics and future marketability

Because security, returns, and the future go hand in hand

The demand for nursing care places is increasing year on year. Demographic change means that modern nursing care facilities are one of the fastest-growing markets in Germany. Anyone investing in nursing care real estate today benefits twice over: from a crisis-proof tangible asset and from stable, long-term rental income.

Care properties combine investment opportunities with social added value. While you secure and build up your assets in a targeted manner, you are also creating urgently needed living space for an aging society. An investment with substance—and with responsibility.

Why care properties?

An investment with a sustainable competitive advantage

The demographic trend in Germany is irreversible: the number of people requiring care will rise to over 6.5 million by 2050 – a significant, sustainable growth driver for the market for inpatient care properties. This fundamental demand offers investors a future-proof market with predictable cash flows.

From an economic perspective, investors benefit from several key competitive advantages:

Long-term contract security

Operators generally conclude lease agreements with terms of 20 to 25 years, which creates stable and predictable income with a significantly reduced risk of vacancy.

Low management costs

As the owner, you don't have to worry about finding tenants, maintenance, or operations—the operator takes care of all that. This minimizes operational effort and the associated risks.

Government subsidies and grants

In addition to depreciation, investors benefit from additional purchase costs, special interest rates, or other subsidies, depending on the project, which reduce the effective investment costs.

Security thanks to land registry entry

The apartment can be inherited, gifted, mortgaged, or sold.

Inflation protection through indexation

Rents are often linked to the consumer price index. This means that your income remains stable even during periods of inflation.

Tax efficiency

Linear and declining balance depreciation options (§7b EStG) offer significant tax advantages, which significantly increase the net return.

Solid building structure

Care apartments are built according to the highest quality standards and the latest findings in geriatric care.

Is a care property suitable?

In summary, care properties offer a combination of secure, long-term income, tax optimization, and operational relief as an investment—ideal conditions for conservative investors who value sustainable growth and stable cash flows.

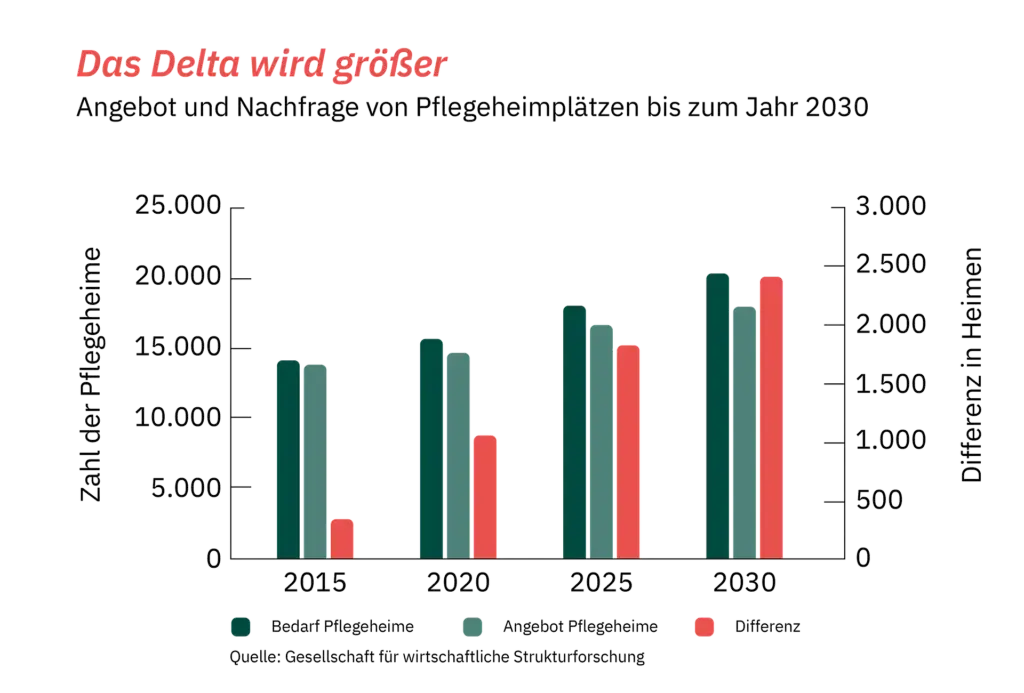

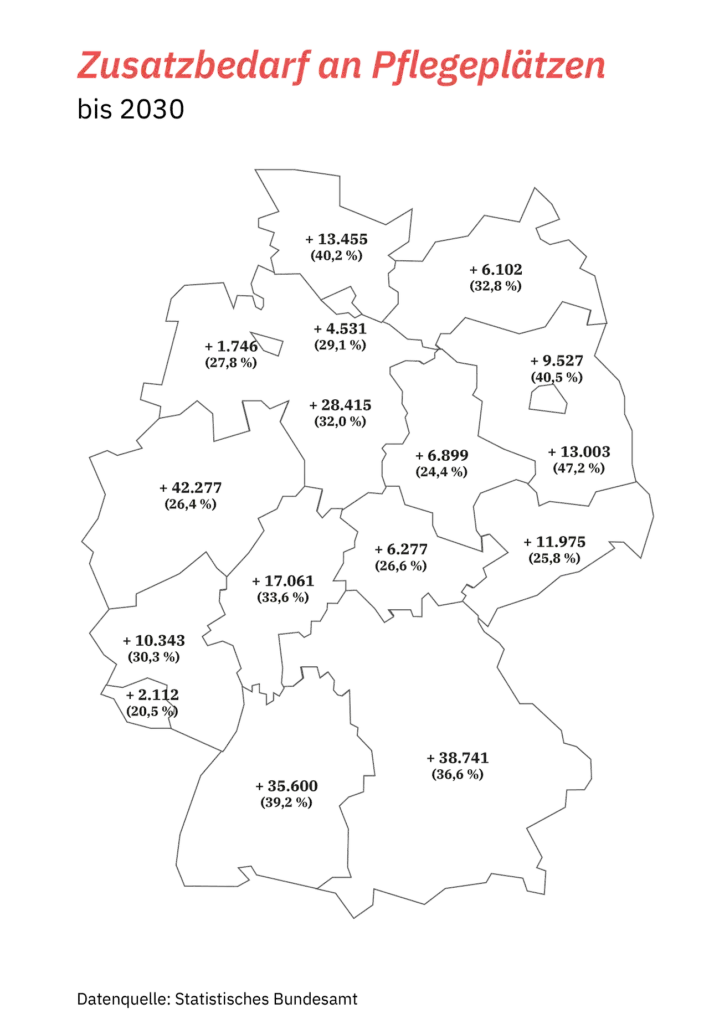

The demand for nursing homes is growing – and supply is lagging behind

In Germany, the demand for modern nursing and retirement homes is growing rapidly. To meet this demand, around 300 new nursing homes would be needed each year – but in reality, far fewer are being built. Currently, only about 230 new facilities are being built each year. This means that over the next twelve years, there will be a shortfall of over 1,800 nursing homes and more than 120,000 nursing care places.

The situation is also tense in the area of assisted living. There is already a shortage of over 550,000 senior-friendly apartments. By 2040, this gap could widen to almost 1 million units. With the current construction rate of around 6,000 new units per year, it will be almost impossible to meet this demand.

The result: a massive investment requirement of between €80 billion and €125 billion – and an enormous opportunity for investors to enter this growing market at an early stage.

Shortage of nursing homes until 2037

shortage of nursing home places in 12 years

There will be a shortage of senior-friendly housing by 2040.

Estimated investment requirements in the care market

Request care property

Learn more about this investment opportunity

"*" indicates required fields

FAQs about capital investment

Why invest in healthcare real estate?

Predictable income: operating agreement + government refinancing

Low administrative costs: Operator takes care of administration and maintenance

Tax advantages: Depreciation (linear + §7b declining balance), interest & purchase costs deductible

Net asset value & ownership: Land registry entry, no fund, real property

Family benefit: Preferential occupancy rights with the operator in the event of an investor requiring long-term care

1. Individual consultation & location selection

2. Financing check, calculation of subsidy options

3. Purchase, notarization, handover, and support

Risks & frequently asked questions

What you should know before buying

Security: Selection of reputable operators, security via land register, option to switch

Operator is regularly inspected, investor is not liable

Market growing, second demand often present in owners’ association, increase in value realistic

Operator takes over care and maintenance

The following documents are usually required to clarify financial viability:

1. Proof of income:

-

Last 3 pay slips (for employees)

-

Current pension statement (for pensioners)

-

Current BWA, EÜR, tax assessment (for self-employed persons/freelancers)

2. Tax documents:

-

Last income tax assessment

-

Last year’s tax return, if applicable

3. Proof of assets:

-

Current bank statements (checking account, call money account, securities account – usually for the last 3 months)

-

Proof of equity capital (e.g., savings accounts, securities accounts, building society savings accounts)

-

If applicable, overview of existing real estate holdings, including market values

4. Personal documents:

-

Identity card or passport (copy of front and back)

-

Self-disclosure (often provided by the bank)

-

SCHUFA credit report (if not obtained by the bank)

5. Existing liabilities:

-

Overview of existing loans (installment amount, remaining debt, term)

-

If applicable, credit agreements or loan overview

Everything you need to know about secure investing in healthcare real estate.

Legal

Legal notice: Section 34c GewO (German Trade Regulation Act), no advice pursuant to Section 34f GewO

Disclaimer: Note: This page does not constitute tax advice. All information is project-dependent. Individual consultation is required.

Legal information: Privacy policy